SIMBA Telecom released it’s Financial Report for half year ended 31 Jan 2025. (1 August 2024 to 31 January 2025). Based on the results release, SIMBA has reached another milestone with continued increase in subscribers for both mobile and fibre broadband service and has achieved maiden half year net profit after tax.

5G Network Expansion

Simba has significantly surpassed the IMDA-mandated 5G coverage milestone of 60% set for December 2023. The company remains on track to meet the next network coverage requirement set by IMDA, due in December 2026. Currently, Simba’s 5G outdoor coverage exceeds 90%.

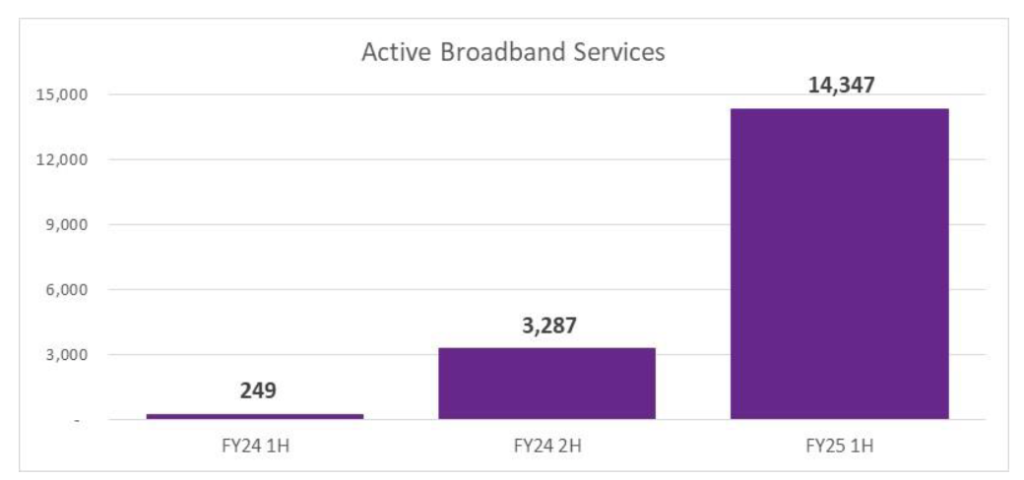

Fibre Broadband

In FY24, Simba introduced its Fibre Broadband service to the Singapore market. The country has nine central offices that serve as distribution hubs for fixed fibre broadband to residential homes. Simba has successfully launched services from all these central offices, offering high-value 2.5 Gbps plans. In the first half of FY25, the company upgraded its fixed-line network to support 10Gbps services, strengthening its position in the Singapore broadband market with competitive value plans.

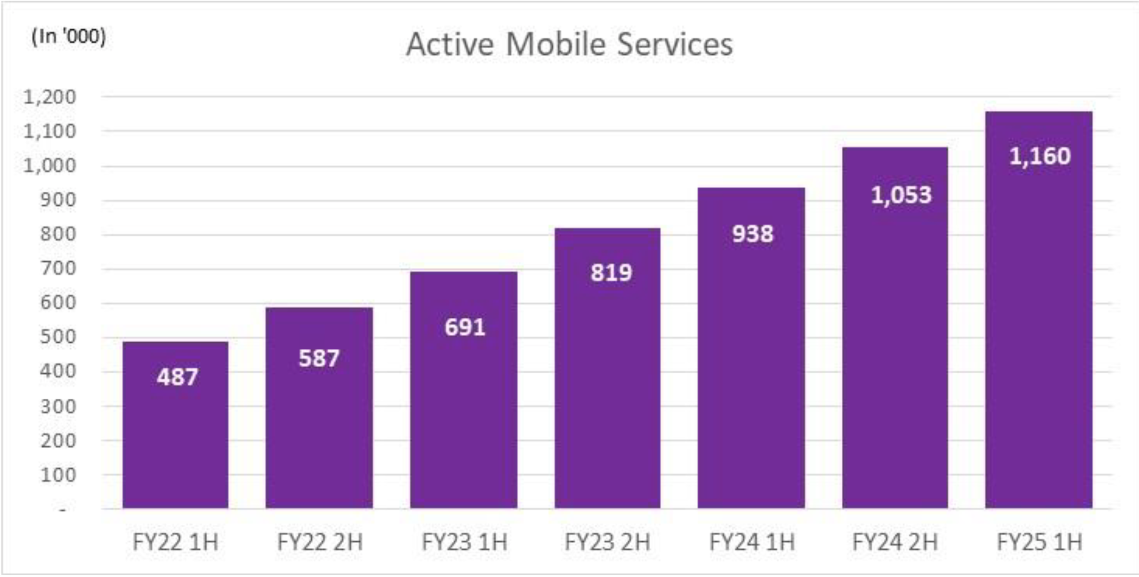

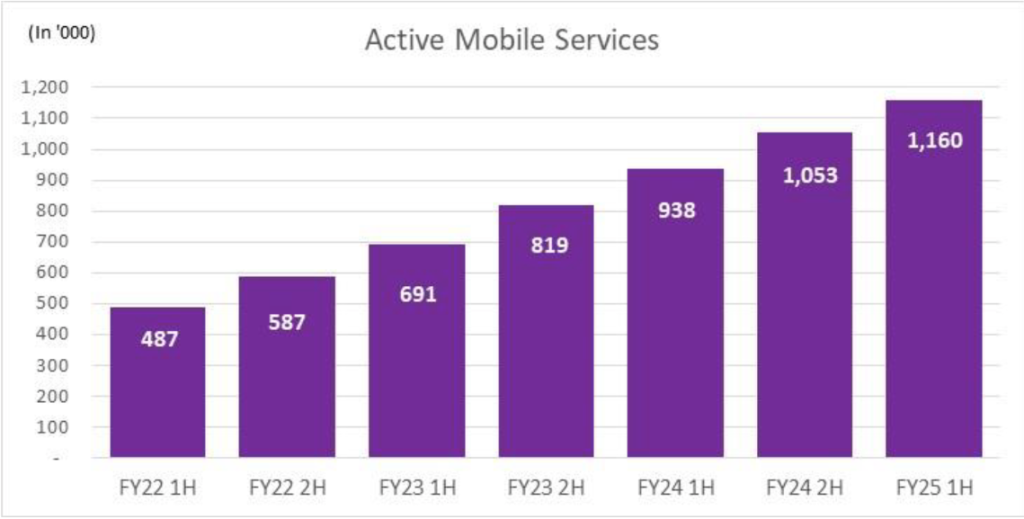

Subscriber Growth

As of 31 January 2025, Simba had approximately 1,160,000 active monthly paid mobile subscribers, up from around 1,053,000 as of 31 July 2024, with consistent month-on-month growth. Additionally, Simba recorded over 14,000 active Fibre Broadband subscribers by the end of the half-year period.Interim Financial Report for the half year ended 31 January 2025

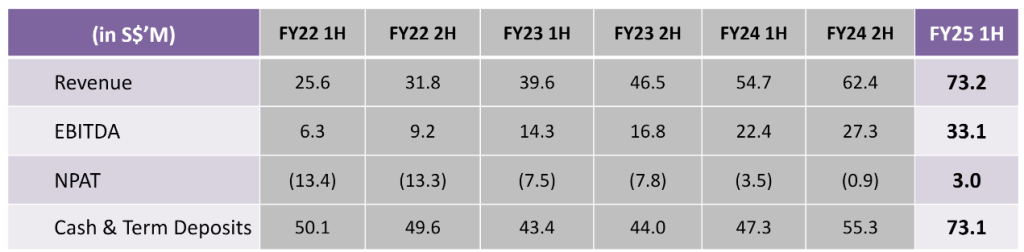

Financial Results

SIMBA has achieved maiden half year net profit after tax. 1H FY25 ARPU of $9.62

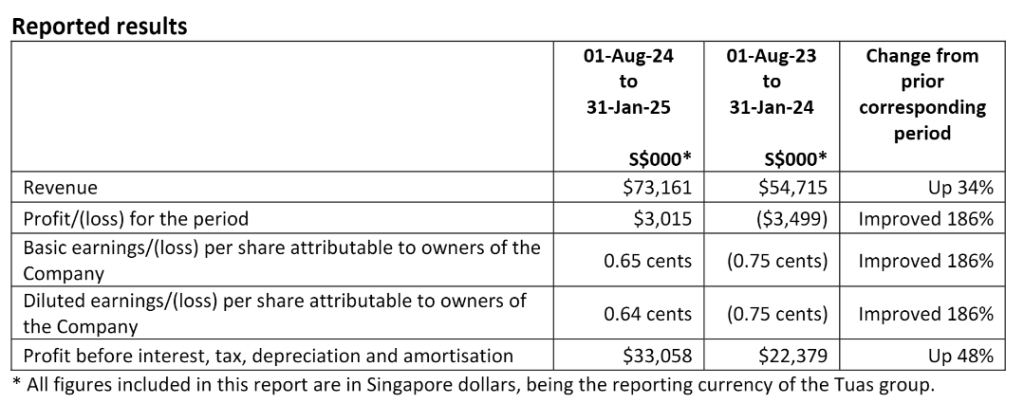

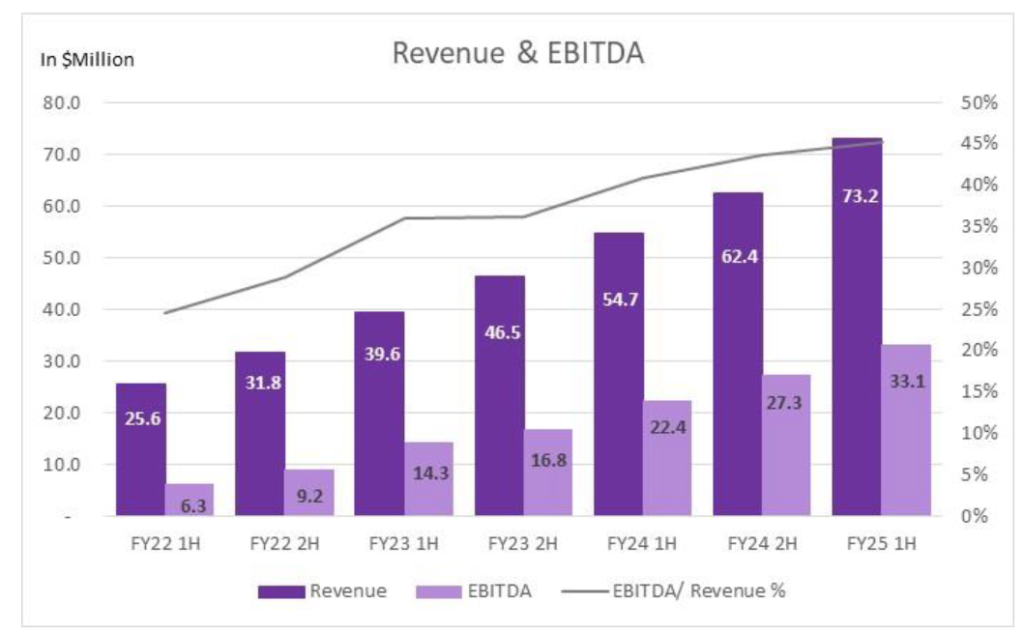

Revenue

For the half-year period, total revenue reached S$73.2 million (2024: S$54.7 million). The core business—providing mobile phone and broadband services—accounted for S$73.1 million (2024: S$54.6 million).

Profitability

Operational costs amounted to S$40.1 million (2024: S$32.3 million), leading to an EBITDA of S$33.1 million (2024: S$22.4 million). After deducting depreciation and amortisation expenses of S$28.2 million (2024: S$25.7 million), the company reported an operating profit of S$4.9 million, a significant improvement from the operating loss of S$3.3 million in 2024.

With net finance income of S$0.4 million (2024: S$0.6 million) and an income tax expense of S$2.3 million (2024: S$0.8 million), the profit after tax stood at S$3.0 million, compared to a loss after tax of S$3.5 million in 2024.

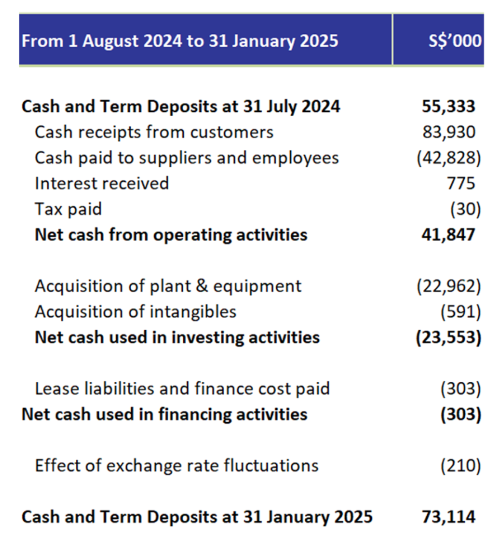

Cash Flow and Capital Expenditure

The company maintained a positive net cash flow, increasing its cash and term deposits by S$17.8 million (2024: S$3.3 million) over the six-month period ending 31 January 2025.

To stay competitive and enhance value differentiation, the company is making continuous investments in network CAPEX to support subscriber growth and improve service quality. Yesterday, SIMBA Telecom just updated it’s plans to include Shared Data Roaming in Hong Kong after adding in Indonesia to some of it’s plans earlier. The top up $20 for $20 and Switch over promotion was well received during the IT SHOW.

Ongoing 5G upgrades and coverage expansion are progressing efficiently, ensuring better connectivity and user experience. Due to the allocated bands, there is some limitation in terms of speed but improved coverage and low latency could be improved in many areas to cater to a larger user base.

Additionally, the company is exploring opportunities in the data-only segment, aiming to cater to the increasing demand for high-speed internet and digital services. These strategic initiatives position the company for long-term growth and strengthen its market presence.