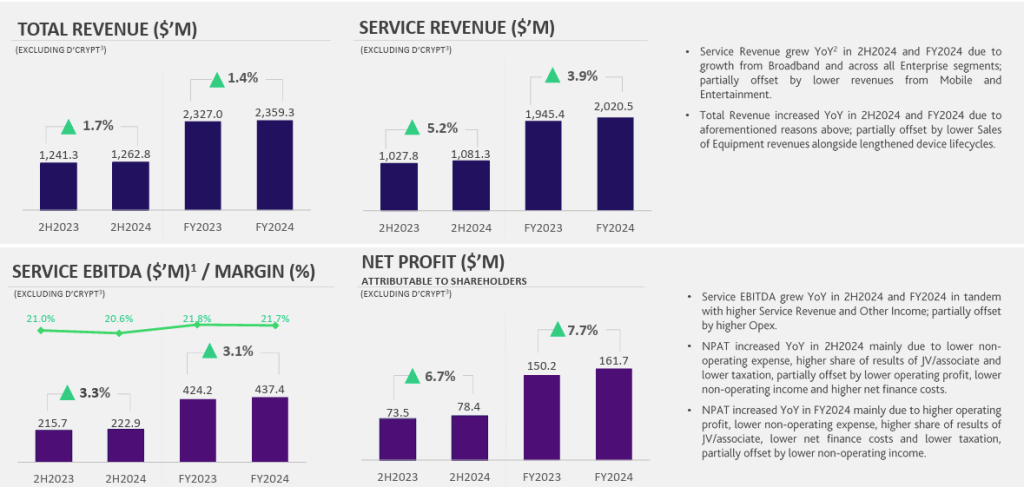

StarHub reported a net profit of S$78.4 million for the second half of its financial year ending in December, marking a 7.5% increase from S$72.9 million in the same period last year.

This means earnings per share rose to S$0.043, up from S$0.04 in the second half of 2023.

However, overall revenue for the period dipped slightly by 0.3% year-on-year to S$1.3 billion, mainly due to lower earnings from its mobile, entertainment, and equipment sales businesses. The decline was partially offset by growth in its broadband and enterprise segments.

Service revenue, which includes earnings from subscriptions and business services, increased by 2.6% to S$1.1 billion. Meanwhile, service earnings before interest, taxes, depreciation, and amortization (EBITDA) grew by 1.6% to S$222.9 million.

If you exclude D’Crypt, a cryptographic technology firm that StarHub sold to ST Engineering last year, the company’s second-half service revenue and total revenue would have still stood at S$1.1 billion and S$1.3 billion, respectively.

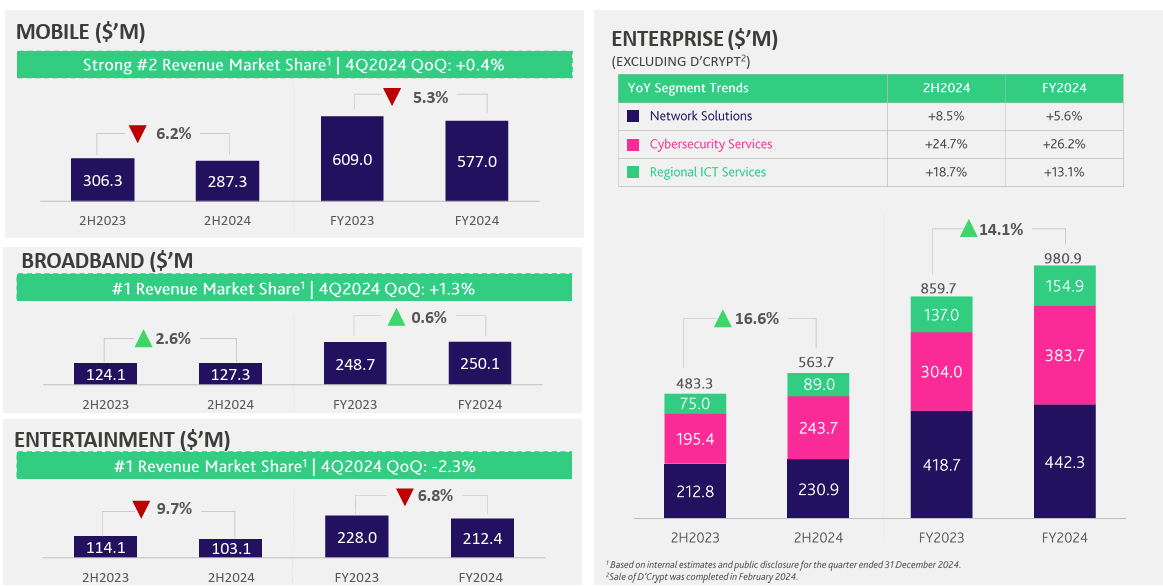

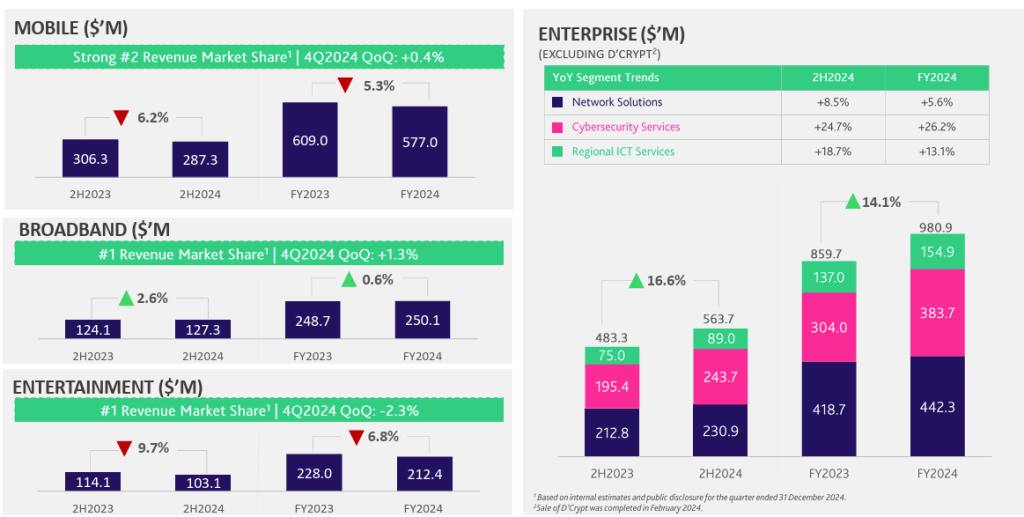

Breakdown by Segment:

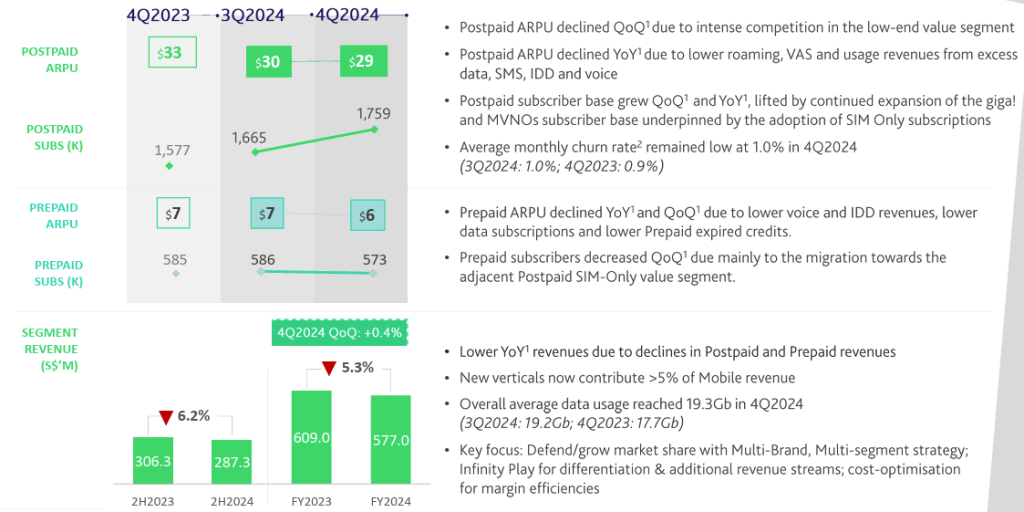

- Mobile service revenue fell 6.2% year-on-year to S$287.3 million, mainly due to lower earnings from both postpaid and prepaid plans.

- Entertainment revenue dropped 9.7% to S$103.1 million, as subscriber numbers declined along with weaker commercial TV and advertising revenue.

- Broadband revenue increased by 2.6% to S$127.3 million, thanks to higher subscription revenue from faster internet plans and bundled services.

- Enterprise business revenue rose 10.7% to S$563.7 million, driven by growth in data and internet services, managed services, cybersecurity, and regional ICT solutions.

Mobile Subscriber Base expanding but ARPU dropping

Although subscriber base grew QoQ lifted by giga, eight and mvnos, the ARPU declined due to intense competition in value segment. The subscriber base of it’s post paid is now at 1.759 million and pre paid at 573 thousand.

Dividend & Full-Year Performance:

StarHub declared a final dividend of S$0.032 per share, down from S$0.042 per share last year. This will be paid out on May 16.

Adding in the interim dividend of S$0.03 per share, the total dividend for the full year 2024 comes to S$0.062 per share. While this is slightly above the company’s initial guidance of S$0.06 per share, it is lower than the S$0.067 per share paid in 2023.

For the full financial year, StarHub’s net profit grew 7.3% to S$160.5 million, while total revenue slipped slightly by 0.2% to S$2.4 billion.