YouTrip, Singapore’s preferred multi-currency digital wallet, now allows users to transfer funds back to their bank accounts. Users can also link their bank accounts for a convenient top-up process. These enhancements are aimed at providing greater flexibility and confidence in spending. Invitations to experience these new features will be sent to YouTrip users progressively over the next few days.

Seamless Top-Ups and Withdrawals, With No Fees

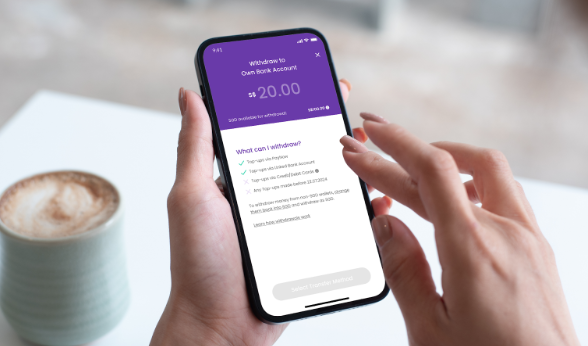

Responding to popular demand, YouTrip now enables users to withdraw funds to their bank accounts using their mobile number or NRIC linked to their YouTrip account. Starting from July 22, 2024, withdrawals are available for new top-ups made through PayNow or the new ‘Linked Bank Account’ method.

Only funds in the Singapore Dollar (SGD) wallet can be withdrawn. To withdraw funds from other currency wallets, users must first convert them to SGD. Withdrawable funds will be shown as the ‘transferable balance.’ Users can make up to 10 free withdrawals per month.

Effortless Top-Ups with Linked Bank Accounts

YouTrip has introduced a new top-up method that allows users to link their bank accounts directly for seamless wallet top-ups. This ‘Linked Bank Account’ option joins existing fee-free methods such as PayNow, Mastercard, and Visa (Debit). Users need to enter their bank information and complete the authentication process once to enjoy continuous top-ups.

Recent Enhancements and Increased Limits

These new features follow YouTrip’s increased limits earlier this year. In January, YouTrip became the first digital wallet in Singapore to raise its limits to S$20,000 for wallet hold and S$100,000 annual spending, up from S$5,000 and S$30,000, respectively, in accordance with updated regulations.

Enhanced Security for Greater Peace of Mind

User security remains a top priority for YouTrip. Users can set top-up limits and expiry dates for bank account linkages to enhance control and security. Additionally, funds can only be withdrawn to the PayNow account linked to the user’s YouTrip registered mobile number or NRIC, preventing fraudulent transfers in case of account takeover attempts.