EZ-Link partners You Technologies Group and Mastercard to launch first multi-currency mobile wallet for Singapore travellers

Save on currency conversion fees and mark-ups with YouTrip for more than 150 currencies worldwide

SINGAPORE, 7 August 2018 – EZ-Link Pte Ltd, You Technologies Group and Mastercard® today launched YouTrip, the first multi-currency mobile wallet enabling users to pay in more than 150 currencies when overseas or shopping online without any currency conversion or transaction fees. This tri-party collaboration marks EZ-Link’s first advancement into FinTech, pioneering the future of multi-currency payments in the region.

YouTrip is a multi-currency mobile wallet with a contactless Mastercard prepaid card issued by EZ-Link in collaboration with You Technologies Group for users to pay at more than 30 million Mastercard merchants worldwide.

With YouTrip, users do not need to incur fees typically charged for currency exchange at banks and money changers or overseas bank card transactions; as well as online currency conversion and transaction fees typically incurred for cross-border payments. The YouTrip card currently supports no-fee overseas transactions in over 150 currencies.

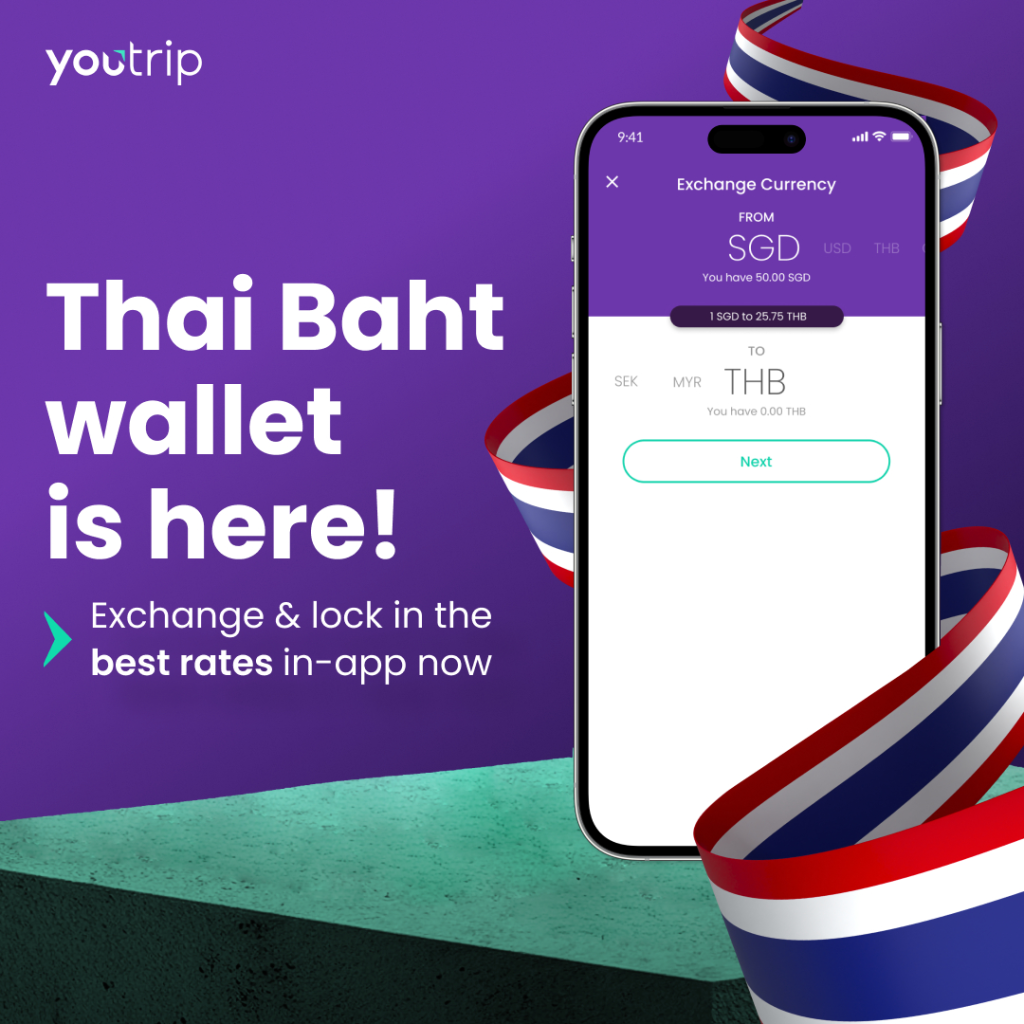

Users can also use the YouTrip app to maximise savings by monitoring live foreign exchange rates on the go and instantly exchange and store up to 10 selected currencies in their wallets at their preferred rates, with no additional fees or mark-ups. The 10 wallet currencies are SGD, HKD, JPY, AUD, NZD, EUR, GBP, CHF, USD and SEK.

With the YouTrip SmartExchange™ technology, users can also use leftover currencies to transact in any of the 150 and more currencies during their next trip or in Singapore. The app will automatically convert leftover currencies at wholesale exchange rates at no additional fees for users to complete transactions when there is insufficient balance for the transacting foreign currencies.

The YouTrip app provides instant notification upon every transaction and allows instant card deactivation when the linked Mastercard is lost or misplaced, to give users peace of mind. As users can check their balance and top up on the go, they will never have to worry about running out of cash when overseas.

Signing up for a YouTrip account is free and does not require any minimum account balance or card fees. Topping up the YouTrip wallet in SGD with any debit or credit card is also free and each account can store up to S$3,000.

“EZ-Link is excited to create a multi-currency wallet designed for travelling and online spenders from Singapore by drawing upon our deep understanding of their payment needs and desires. By collaborating with You Technologies Group and Mastercard, we aim to translate the transformative power of disruptive financial technologies into compelling savings, convenience and security for our customers,” said Mr. Nicholas Lee, CEO, EZ-Link Pte Ltd.

“You Technologies Group has chosen Singapore to be its first market to launch for its vibrant fintech ecosystem and Singaporeans readiness to adopt innovative solutions. Collaborating with EZ-Link was an obvious choice as we aim to create the most reliable and simplest way for people to manage their global spending,” said Mr. Arthur Mak, CEO, You Technologies Group.

Ms Deborah Heng, Country Manager, Mastercard Singapore, said, “According to the latest Mastercard Consumer Purchasing Priorities Index, 7 in 10 consumers in Singapore keep track of their spending on a weekly or monthly basis. The new multi-currency mobile wallet and easy use of the mobile application will allow travellers to track their spending and better manage their budget when travelling overseas. As the appetite for travel continues to grow, having an on-the-go multi-currency payment option will better serve travellers’ needs, and make for a more rewarding travel experience.”

Starting today, YouTrip will accept registration for the first 1,000 users with an early bird bonus of S$20 to be credited upon first successful top up. Users can download the app from App Store or Google Play to register for a YouTrip account within a few minutes, or find out more at www.you.co.

Currently, DBS Mulit Currency AC with debit card which allows you to do online conversion to the selected currency and you in the local currency when overseas. The account requires the Plastic VISA debit card.

UOB’s MightyFX is another such product which allows you to pay through either plastic card or electronically via NFC when overseas.