Singapore’s telecom landscape is on the verge of a shake-up. Simba, the disruptor telco known for its ultra-affordable mobile plans, has made a bold move: it wants to acquire M1, one of the country’s oldest and most established network operators. But why would a lean, low-cost player like Simba want to take on a legacy brand like M1?

Let’s analyse and find out the possible causes.

Market Share: From Underdog to Contender

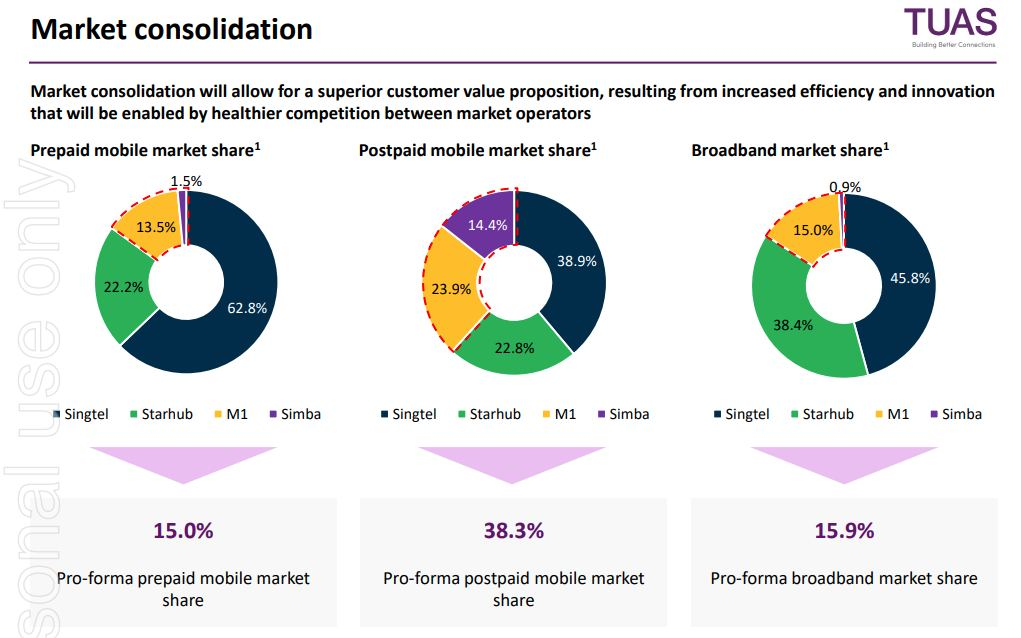

Simba has carved out a niche with its aggressive pricing and data-heavy mobile plans, but its market share still trails the big players. As of now:

- Postpaid Mobile: Simba holds 14.4% vs. M1’s 23.9%

- Broadband: Simba has just 0.9%, while M1 commands 15.9%

By acquiring M1, Simba could leapfrog into a dominant position, potentially controlling 38.3% of the postpaid market and over 15% of broadband.

That would make the combined entity Singapore’s second-largest postpaid mobile operator, trailing only Singtel. It’s not just growth—it’s a reshuffling of the competitive hierarchy.

Infrastructure Synergy: Minimal Overlap, Maximum Gain

Unlike other telco pairings, Simba and M1 have minimal overlap in network resources. The LTE bands and 5G band have almost no overlap. M1’s existing base station are serving in DAS within buildings which SIMBA have little access. Most importantly, it LTE bands 3 and 7—the golden bands prized for their balance of coverage and capacity which SIMBA do not have to wait till 2030 before a bidding exericse is called.

- Band 3 (1800 MHz) offers wide-area coverage and solid indoor penetration

- Band 7 (2600 MHz) delivers high throughput in dense environments

📶 5G and Beyond: Closing the Performance Gap

Simba’s 5G rollout has been functional but limited in performance. Its current 5G NSA (non-standalone) deployment relies on the N1 band, which offers just 10 MHz of bandwidth—not enough to deliver a meaningful speed boost over 4G.

What Simba lacked was band n78, the mid-band spectrum prized for its larger bandwidth and superior throughput. With the acquisition of M1, Simba gains access to n78, finally putting it on par with Singtel and StarHub in terms of 5G performance. It has levelled the ground for better competition.

The same MOCN can be applied on ANTINA (Joint venture for n78 100 MHz band) allowing both existing M1, Starhub and now SIMBA users can enjoy the faster download and lower latency 5G Standalone network.

Post-acquisition, users on both networks will benefit from expanded band access:

| User Type | New Band Access |

|---|---|

| Simba users | B28, B3, B7, B8, n1, n78 (via M1) |

| M1 users | B8, B38, B40, n1 (via Simba) |

Together, Simba-M1 will support the widest range of LTE and 5G bands in Singapore, including:

- LTE: B3, B7, B8, B28, B38, B40

- 5G: n1, n78

This band diversity translates into:

- Better indoor and outdoor coverage

- Higher peak speeds and lower latency

- Improved load balancing and network resilience

In short, the combined entity becomes the most spectrum-rich telco in the country—an enviable position for both performance and future scalability.

Final Thoughts

With a combined postpaid market share of 38.3%, Simba-M1 would become Singapore’s second-largest telco, challenging the status quo and setting the stage for a new era of competition.

And with access to band n78 for 5G, bands 3 and 7 for LTE, and a full suite of spectrum assets, Simba-M1 becomes the most technically equipped telco in the country—ready to deliver speed, reliability, and future-readiness to its growing user base.

The question now is whether the deal will be approved by IMDA. If approved, how will it be executed. TUAS also took a loan and placement shares, it will need to be able to manage it well to ensure a smooth transition. Will that also translate to more pricey mobile and broadband plans.

That all remains to be seen. Do post your comments in our FB comment section at

https://www.facebook.com/OCWorkbench

You can alao read our related reactions to the acquistion news here